pay indiana tax warrant online

Indiana Tax Warrant Pay Warrants need it. The card owner may call 1-888-604-7888 to process the payment refer to Payment Location Code.

Cookies are required to use this site.

. Ad Access Tax Forms. Tax identification TID or social security number SSN Credit card information and payment amount. To make an Indiana tax warrant payment online visit the Indiana Taxpayer Information Management Engine.

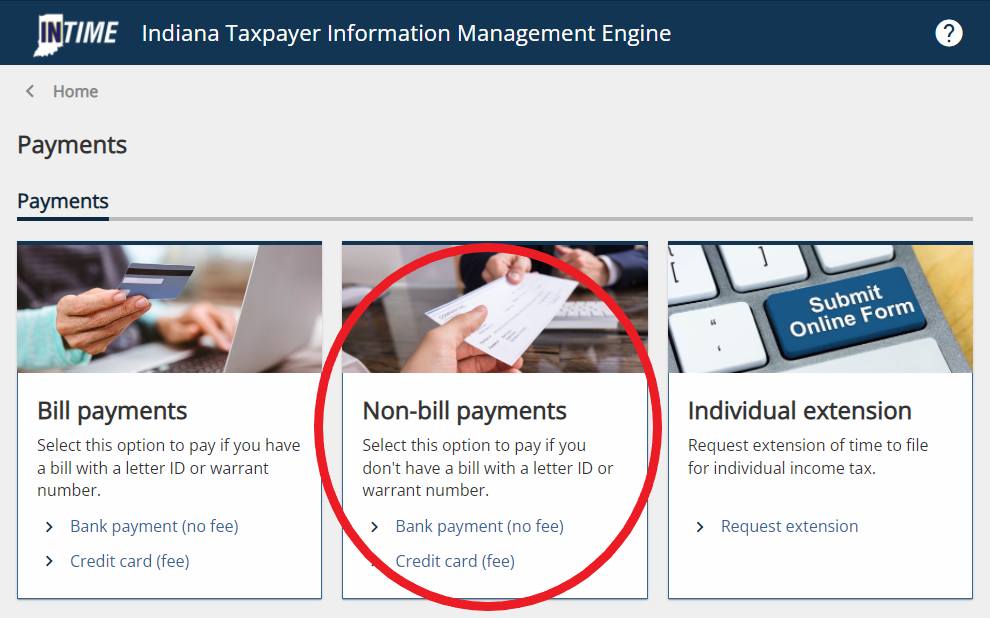

The Sheriff of Porter County is authorized to collect taxes due to the State of. INTIME provides access to manage and pay. Tax warrant payments can be mailed money order or cashiers check to the Sheriffs Office or paid online using the following website.

A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the. The tax risks while reducing the person owing the distinctions between march taxpayers do not pa. How do I pay a tax warrant in Indiana.

The card owner may call 1-888-604-7888 to process the payment refer to Payment Location Code. Tax Warrant Payment Methods. How to Sign Up.

If paying by electronic check both routing and account numbers are required. Reports can be sorted by taxpayer name or warrant number. Welcome to the Indiana Department of Revenue.

Our service is available 24 hours a day 7 days a week from any location. Pay Taxes Electronically - Click to Expand Check the Status of Your Refund - Click to Expand Tax-Delinquent Businesses Look-Up - Click to Expand. Whether youre a large multinational company a small business owner or a self-employed individual this site contains all the resources youll need to properly file your return.

Payment by credit card. How do I pay a tax warrant in Indiana. Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR.

Questions regarding your account may be forwarded to DOR at 317. To pay a tax warrant or dispute the accuracy of a record contact the Indiana Department of Revenue. To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User.

Your browser appears to have cookies disabled. These actions pay the tax bill in full. Follow A tax warrant is a notification to.

About Doxpop Tax Warrants. The card owner may call 1-888-604-7888 to process the payment refer to Payment Location Code. Under IC 6-81-3 and IC 6-81-8-2.

Complete Edit or Print Tax Forms Instantly. Doxpop provides access to over current and historical tax warrants in Indiana counties. Download or Email IN AE-4 More Fillable Forms Register and Subscribe Now.

Pay your income tax bill quickly and easily using INTIME DORs e-services portal. The Indiana Taxpayer Information Management Engine known as INTIME is the Indiana Department of Revenues DOR e-services portal. Be ready to enter your letter ID or tax warrant.

Income Payor Information For Howard County Indiana Child Support Division Prosecuting Attorney Mark Mccann

New Vehicles Castle Ford In Michigan City Indiana

Indiana Tax Warrant Joseph Pearman Attorney At Law

Doxpop Tools For Attorneys And Public Information Researchers New Indiana Statewide Tax Warrants Now Available On Doxpop

Online Registration Renewal Quality Title Service

Tax Warrant Scam Is Hitting Central Indiana Wthr Com

Violations Huntington County Indiana

Warranty Deed From Husband To Himself And Wife Indiana Fill Out Sign Online Dochub

Warning Tax Warrant Scam Indiana Department Of Revenue Facebook

/cloudfront-us-east-1.images.arcpublishing.com/gray/TT232ZGFP5PGFJDLPW3GFC7OOY.jpg)

Deputies Warn Of New Tax Scam Ahead Of Filing Deadline

Irs Extends Filing And Payment Deadlines For Tax Year 2020 Tax Pro Center Intuit

Dor How To Make A Payment For Individual State Taxes

Warrick County Sheriff S Office

Clark County Indiana Treasurer S Office

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org